VA home loans are a valuable benefit for veterans, active-duty service members, and eligible surviving spouses. Backed by the U.S. Department of Veterans Affairs (VA), these loans offer favorable terms and help make homeownership more accessible for those who have served our country. This guide will explain what VA home loans are, their benefits, eligibility criteria, and the application process.

What is a VA Home Loan?

A VA home loan is a mortgage guaranteed by the U.S. Department of Veterans Affairs. The VA does not lend money directly; instead, it provides a guaranty to lenders, reducing their risk and enabling them to offer better terms to qualified borrowers. VA loans can be used to purchase, build, repair, retain, or adapt a home for personal occupancy.

Benefits of VA Home Loans

- No Down Payment: Qualified borrowers can purchase a home with no down payment, making it easier to afford homeownership.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, VA loans do not require PMI, reducing monthly payments.

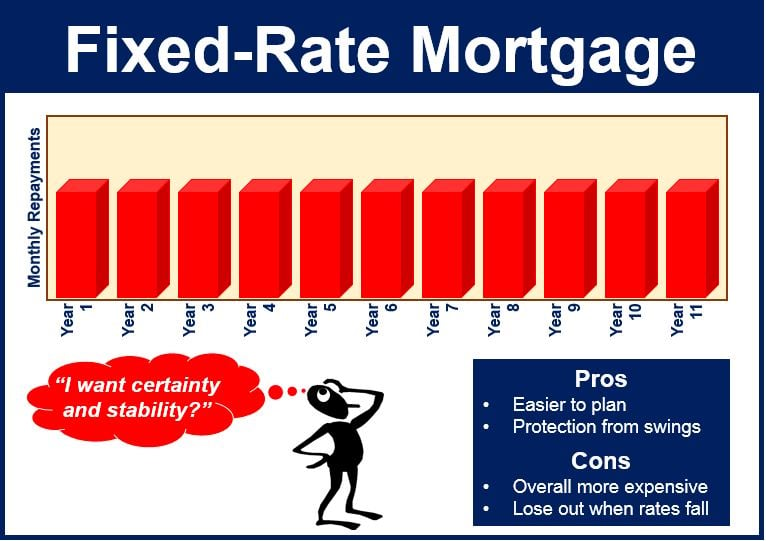

- Competitive Interest Rates: VA loans typically offer lower interest rates compared to conventional loans, saving borrowers money over the life of the loan.

- Flexible Credit Requirements: VA loans have more lenient credit requirements, making it easier for borrowers with less-than-perfect credit to qualify.

- Limited Closing Costs: The VA limits the amount of closing costs that veterans can be charged, making the home buying process more affordable.

- Assumable Loans: VA loans are assumable, meaning that if you sell your home, the buyer can take over your existing mortgage, potentially benefiting from your lower interest rate.

- Foreclosure Avoidance Support: The VA provides assistance to help veterans avoid foreclosure through counseling and negotiating with lenders.

Eligibility Criteria for VA Loans

To be eligible for a VA home loan, you must meet one of the following criteria:

- Service Requirements:

- Veterans: Served 90 consecutive days of active service during wartime, or 181 days of active service during peacetime, or six years in the National Guard or Reserves.

- Active-Duty Service Members: Currently serving and have served 90 consecutive days.

- Surviving Spouses: Unremarried surviving spouse of a service member who died in the line of duty or as a result of a service-related disability.

- Certificate of Eligibility (COE): You must obtain a COE from the VA to prove your eligibility. Lenders can often help you obtain this certificate.

- Credit and Income Requirements: While the VA does not set a minimum credit score, most lenders require a minimum score of 620. You must also have a stable income and meet debt-to-income ratio requirements.

How to Apply for a VA Home Loan

1. Check Your Eligibility

Verify that you meet the VA’s service requirements and obtain your Certificate of Eligibility (COE). You can apply for your COE online through the VA’s eBenefits portal, by mail, or through your lender.

2. Check Your Credit

Review your credit report and address any issues. Improving your credit score can help you secure better loan terms.

3. Determine Your Budget

Calculate how much you can afford by considering your income, expenses, and potential down payment. Use online calculators to estimate your monthly mortgage payments.

4. Find a VA-Approved Lender

Not all lenders offer VA loans, so find a lender experienced with VA financing. Compare rates, fees, and customer reviews to choose the best lender for your needs.

5. Get Pre-Approved

Obtain a mortgage pre-approval from your chosen lender. This involves a preliminary review of your finances and gives you an estimate of how much you can borrow.

6. Find a Home

Work with a real estate agent familiar with VA loans to find a home that meets your needs and budget. Ensure the property meets VA standards and undergoes a proper appraisal.

7. Complete the Application

Submit a complete loan application with your lender, including all required documentation. The lender will process your application, order an appraisal, and verify your financial information.

8. Close the Loan

Once your loan is approved, you’ll go through the closing process. Review and sign the loan documents, pay any closing costs, and officially become a homeowner.

Example of Savings with a VA Home Loan

Consider a $300,000 mortgage:

Conventional Loan:

- Down Payment: $60,000 (20%)

- Interest Rate: 4.5%

- Monthly Payment: $1,216 (principal and interest)

- PMI: $0

VA Loan:

- Down Payment: $0

- Interest Rate: 4.0%

- Monthly Payment: $1,432 (principal and interest)

- PMI: $0

In this example, the VA loan requires no down payment, offers a lower interest rate, and has no PMI, making it more affordable upfront and over the life of the loan.

Conclusion

VA home loans provide a powerful benefit for veterans, active-duty service members, and eligible surviving spouses, offering favorable terms that make homeownership more accessible. By understanding the benefits, eligibility criteria, and application process, you can take full advantage of this valuable benefit and achieve your homeownership goals. Working with experienced professionals can help you navigate the VA loan process and secure the best terms for your mortgage.