Refinancing your home loan can be a strategic move to save money, lower monthly payments, or access home equity for other financial needs. However, it’s essential to understand the process, benefits, and potential pitfalls before deciding to refinance. This comprehensive guide will walk you through everything you need to know about home loan refinancing.

What is Home Loan Refinancing?

Home loan refinancing involves replacing your existing mortgage with a new one, typically with different terms. The new mortgage pays off the original loan, and you start making payments on the new loan. Homeowners refinance for various reasons, including securing a lower interest rate, reducing monthly payments, or tapping into their home equity.

Benefits of Refinancing Your Home Loan

- Lower Interest Rates: One of the most common reasons to refinance is to take advantage of lower interest rates. A lower rate can significantly reduce your monthly payments and the total amount paid over the life of the loan.

- Reduced Monthly Payments: By securing a lower interest rate or extending the loan term, you can lower your monthly mortgage payments, freeing up cash for other expenses or savings.

- Shorten Loan Term: Refinancing to a shorter loan term can help you pay off your mortgage faster and save on interest. While this may increase your monthly payments, it reduces the overall interest paid.

- Access Home Equity: A cash-out refinance allows you to tap into your home equity, providing funds for home improvements, debt consolidation, or other financial needs.

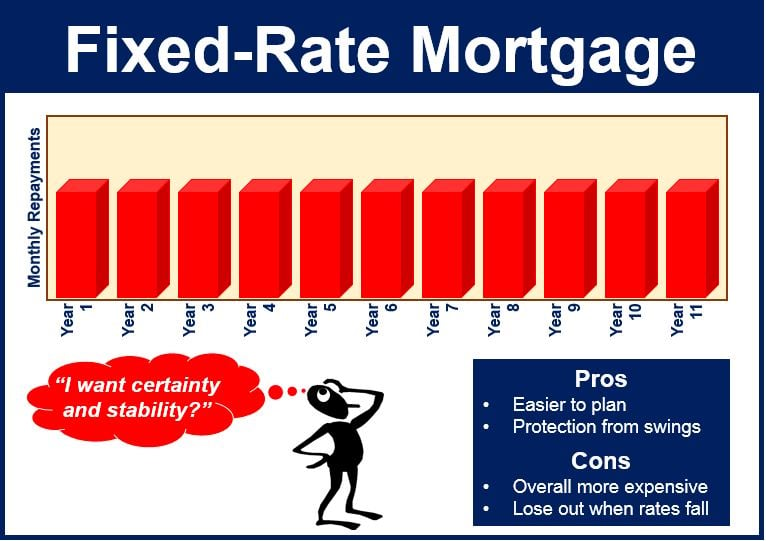

- Switch Loan Types: Refinancing can allow you to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing stability and predictable payments.

When to Consider Refinancing

- Falling Interest Rates: If interest rates have dropped since you took out your original mortgage, refinancing could save you money.

- Improved Credit Score: If your credit score has improved, you may qualify for better loan terms and a lower interest rate.

- Change in Financial Situation: If your income has increased or decreased, refinancing can help adjust your mortgage to better suit your current financial situation.

- Equity in Your Home: If you’ve built significant equity in your home, a cash-out refinance can provide funds for large expenses or investments.

Steps to Refinance Your Home Loan

- Assess Your Financial Goals: Determine why you want to refinance and what you hope to achieve. Whether it’s lowering your interest rate, reducing monthly payments, or accessing equity, having clear goals will guide your decisions.

- Check Your Credit Score: A higher credit score can help you secure better loan terms. Obtain a copy of your credit report and address any issues before applying.

- Shop Around for Lenders: Compare rates and terms from multiple lenders to find the best deal. Consider banks, credit unions, and online lenders.

- Calculate the Costs: Refinancing comes with closing costs, which can range from 2% to 5% of the loan amount. Ensure the savings from refinancing outweigh these costs.

- Gather Documentation: Be prepared to provide financial documents, including tax returns, pay stubs, bank statements, and information about your current mortgage.

- Apply for the Loan: Once you’ve chosen a lender, submit your application. The lender will review your credit, financials, and the value of your home.

- Lock in Your Rate: If you’re satisfied with the offered rate, consider locking it in to protect against rate increases during the processing period.

- Close the Loan: Review and sign the closing documents. Your new lender will pay off your existing mortgage, and you’ll start making payments on the new loan.

Potential Pitfalls of Refinancing

- Closing Costs: Refinancing isn’t free. Make sure the savings outweigh the costs.

- Longer Loan Term: Extending your loan term can lower monthly payments but increase the total interest paid over time.

- Risk of Foreclosure: A cash-out refinance increases your mortgage balance and monthly payments, which could be risky if your financial situation changes.

- Credit Impact: Applying for a new loan can temporarily lower your credit score. Make sure your credit is in good shape before refinancing.

Conclusion

Home loan refinancing can offer significant financial benefits, from lower interest rates to reduced monthly payments and access to home equity. However, it’s crucial to weigh the costs and potential risks against your financial goals. By understanding the refinancing process and carefully considering your options, you can make an informed decision that enhances your financial stability and helps you achieve your long-term objectives.